Gold ETF inflows hit 5-year high as tariffs drive safe-haven bets

Anabelle Colaco

10 Jul 2025, 23:45 GMT+10

- Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half of 2020 from January to June, data from the World Gold Council showed on July 8

- A trade war sparked by U.S. President Donald Trump's tariff policy prompted investors to seek shelter from political and economic volatility in gold ETFs, which account for a significant part of investment demand for the precious metal

- The active first half of the year follows a modest net inflow to gold ETFs in 2024 after three years of outflows caused by high interest rates

LONDON, U.K.: Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half of 2020 from January to June, data from the World Gold Council showed on July 8.

A trade war sparked by U.S. President Donald Trump's tariff policy prompted investors to seek shelter from political and economic volatility in gold ETFs, which account for a significant part of investment demand for the precious metal.

The active first half of the year follows a modest net inflow to gold ETFs in 2024 after three years of outflows caused by high interest rates.

Gold ETFs recorded an inflow of US$38 billion in the first half of 2025, with their collective holdings rising by 397.1 metric tons of gold, said the WGC, an industry body whose members are global gold miners.

This raised the total holdings to 3,615.9 tons by the end of June, the largest since August 2022. Their record was 3,915 tons in October 2020.

U.S.-listed funds led the inflow with 206.8 tons in the first half, while Asia-listed funds drew 104.3 tons, according to the WGC.

"Despite slowing momentum in May and June, Asian investors bought a record amount of gold ETFs during the first half of the year, contributing an impressive 28 percent to net global flows with only nine percent of the world's total assets under management," the WGC added.

Spot gold prices are up 26 percent this year, having hit a record high of $3,500 per troy ounce in April.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Cincinnati Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Cincinnati Sun.

More InformationInternational

SectionTravelers can now keep shoes on at TSA checkpoints

WASHINGTON, D.C.: Travelers at U.S. airports will no longer need to remove their shoes during security screenings, Department of Homeland...

Rubio impersonator used AI to reach officials via Signal: cable

WASHINGTON, D.C.: An elaborate impersonation scheme involving artificial intelligence targeted senior U.S. and foreign officials in...

Warsaw responds to migration pressure with new border controls

SLUBICE, Poland: Poland reinstated border controls with Germany and Lithuania on July 7, following Germany's earlier reintroduction...

Deadly July 4 flash floods renew alarm over NWS staffing shortages

WASHINGTON, D.C.: After months of warnings from former federal officials and weather experts, the deadly flash floods that struck the...

Putin fires transport chief, later found dead in suspected suicide

MOSCOW, Russia: Just hours after his sudden dismissal by President Vladimir Putin, Russia's former transport minister, Roman Starovoit,...

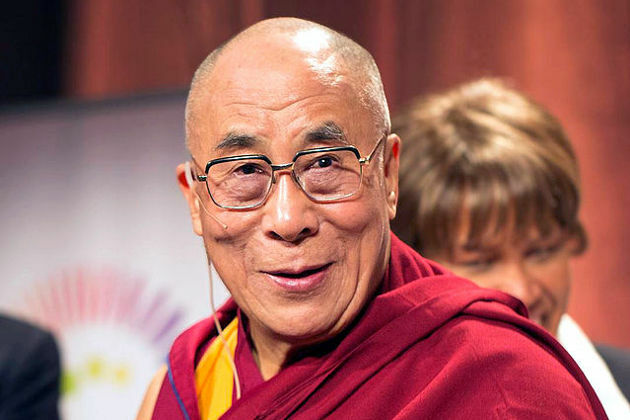

Thousands gather in Himalayas as Dalai Lama celebrates 90th birthday

DHARAMSHALA, India: The Dalai Lama turned 90 on July 6, celebrated by thousands of followers in the Himalayan town of Dharamshala,...

Business

SectionGold ETF inflows hit 5-year high as tariffs drive safe-haven bets

LONDON, U.K.: Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half...

PwC: Copper shortages may disrupt 32 percent of chip output by 2035

AMSTERDAM, Netherlands: Some 32 percent of global semiconductor production could face climate change-related copper supply disruptions...

U.S. stocks recover after Trump-tariffs-induced slump

NEW YORK, New York - U.S. stocks rebounded Tuesday with all the major indices gaining ground. Markets in the UK, Europe and Canada...

Stocks slide as Trump unveils 25% tariffs on Japan, S. Korea

NEW YORK CITY, New York: Financial markets kicked off the week on a cautious note as President Donald Trump rolled out a fresh round...

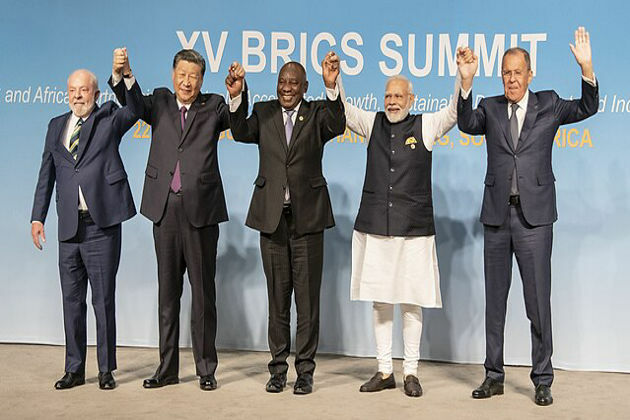

BRICS issues rebuke on trade and Iran, avoids direct US criticism

RIO DE JANEIRO, Brazil: At a two-day summit over the weekend, the BRICS bloc of emerging economies issued a joint declaration condemning...

BP appoints ex-Shell finance chief Simon Henry to board

LONDON, U.K.: This week, BP appointed Simon Henry, former Shell finance chief, to its board as a non-executive director effective September...