Chinese property giants hit hard with nearly USD 3 billion in forex losses

ANI

21 Sep 2023, 08:48 GMT+10

Beijing [China], September 21 (ANI): China's leading real estate firms have reported nearly USD 3 billion in foreign exchange losses for the first half of this year, primarily due to the depreciation of the yuan against the US dollar. This has exacerbated their challenges in generating funds to repay their growing debts, according toNikkei Asia. The total net foreign exchange losses for 24 of the top 30 mainland listed Chinese developers by contracted sales before the COVID crackdown in 2020 totalled 21.25 billion yuan (USD 2.75 billion) for the first six months of this year, according to research by Nikkei Asia.

The foreign exchange losses are on paper only and the actual loss or gain depends on the exchange rates of the respective due dates. But the figures act as a gauge of exchange rate risks involved with the foreign currency-denominated debts of distressed property developers, especially when the yuan dipped to a 16-year low against the dollar on September 8.

Chief Asia Pacific economist at Natixis Alicia Garcia Herrero views the yuan depreciation as a result of increased liquidity due to cuts in reserve requirement ratios and interest rates by the People's Bank of China, which is under stress from the real estate sector.

"Both, together with the now negative portfolio flows into China, have weakened the yuan," she said. The weak yuan is seen as a by-product of assisting distressed developers, but it is apparently adding to the financial burden for those highly exposed to dollar debts.

While Yango Group was forced to delist from the Shenzhen exchange last month and Hong Kong-listed CIFI Holdings Group failed to announce its midyear earnings report by the August 31 deadline, four companies did not explicitly disclose and a few said such losses are included in a wider category of "finance losses." The actual losses by yuan depreciation could be larger, as per Nikkei Asia.

China Evergrande Group topped the list with a net forex loss of 4.14 billion yuan, or 12.5 per cent of the 33 billion yuan net loss for the first six months. Among the 625 billion yuan of total borrowings at the end of June, 26.3 per cent was denominated in U.S. dollars and Hong Kong dollars, where the value of the latter is pegged to the former.

Since the yuan depreciated almost ten per cent over the year until then, the value of Evergrande's debts borrowed in the two foreign currencies are inflated when converted to the Chinese currency.

Country Garden Holdings reported over 3 billion yuan in net foreign exchange loss, contributing to a record half-year net loss of 48.93 billion yuan. Global investors have been closely watching the Guangdong-based developer, as it initially missed a total of USD 22.5 million in interest payments to two of its dollar-denominated bonds last month.

Sunac China Holdings, which has already defaulted on onshore and offshore bonds, said it has recorded a similar loss of 3.24 billion yuan during the first half of the year. The Tianjin-based developer has not repaid 129.23 billion yuan, or over 40 per cent of what it owes to creditors and bankers, as of the end of last month.

(ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Cincinnati Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Cincinnati Sun.

More InformationInternational

SectionOver 60 companies named in UN report on Israel-Gaza conflict

GENEVA, Switzerland: A new United Nations report alleges that dozens of global corporations are profiting from and helping sustain...

UK lawmakers desigate protest group as terrorist organization

LONDON, UK - Lawmakers in the United Kingdom have voted overwhelmingly to proscribe the direct-action group Palestine Action as a terrorist...

Dalai Lama to address Buddhist conference, reveal succession plan

DHARAMSHALA, India: The Dalai Lama is set to address a significant three-day conference of Buddhist leaders this week, coinciding with...

US Supreme Court backs Texas efforts to shield minors online

WASHINGTON, D.C.: In a significant ruling last week, the U.S. Supreme Court upheld a Texas law requiring age verification for users...

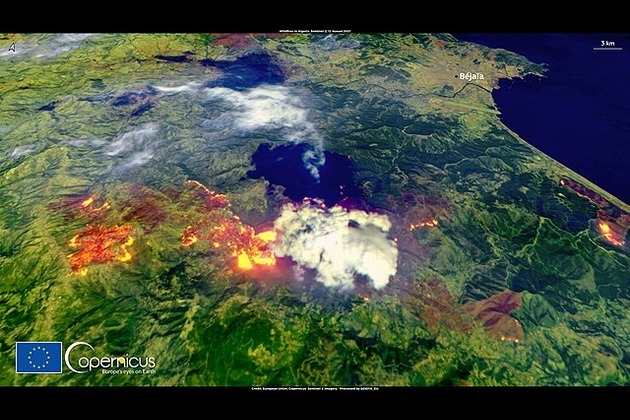

Turkey, France battle wildfires amid early Europe heatwave

ISTANBUL/PARIS/BRUSSELS: As searing temperatures blanket much of Europe, wildfires are erupting and evacuation orders are being issued...

Venetians protest Bezos wedding with march through the town

VENICE, Italy: Over the weekend, hundreds of protesters marched through the narrow streets of Venice to voice their opposition to billionaire...

Business

SectionStandard and Poor's 500 and and Nasdaq Composite close at record highs

NEW YORK, New York -U.S. stock markets closed with broad gains on Thursday, led by strong performances in U.S. tech stocks, while European...

Persson family steps up H&M share purchases, sparks buyout talk

LONDON/STOCKHOLM: The Persson family is ramping up its investment in the H&M fashion empire, fueling renewed speculation about a potential...

L'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

Robinhood launches stock tokens for EU investors, adds OpenAI

MENLO PARK, California: Robinhood is giving European investors a new way to tap into America's most prominent tech names — without...

Wall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...