Gold prices on the rise amid fears of worldwide inflation

RT.com

23 Oct 2021, 15:42 GMT+10

The price of gold this week exceeded $1,800 per ounce, trading data shows. While global investors assess the risks of high inflation, some experts say gold prices could soon double.

The price of December gold futures on the New York Comex stock exchange on Friday jumped 1.69%, to $1812.15 per ounce. Over the week, gold has risen in price by some 2.5%, its fastest weekly growth rate since spring.

The popularity of the precious metal has grown as it is seen as a means of protection against high inflation, a common trend in many countries around the globe despite the assurances of the financial authorities that the phenomenon is temporary.

Kitco analyst Jim Wyckoff, who is quoted by the Wall Street Journal, believes gold prices "are supported by growing fears about inflation and a decline in the dollar index at the end of the trading week." In recent weeks, the dollar has been weakening against a number of major world currencies, in particular, the euro, the yen and the yuan, while the dollar index has dropped by 0.2%, to 93.58 points.

"Experience shows that 'hard' assets such as precious metals are becoming more popular as a hedge of inflation," Wyckoff stated.Meanwhile, industry insiders think gold prices could potentially rise further, likely following the lead of other major commodities, like aluminum and natural gas, as Covid-19 pandemic aftershocks continue to frustrate supply chains.

According to the former chiefs of Canadian gold mining company Goldcorp Inc., David Garofalo and Rob McEwen, global inflationary pressures are not as transitory as central bankers and consumer price indexes suggest. When investors realize this, it could propel gold prices up to $3,000 an ounce.

"I'm talking about months. The reaction tends to be immediate and violent when it does happen. That's why I'm quite confident that gold will achieve $3,000 an ounce in months not years," Garofalo, who now heads Gold Royalty Corp, told Bloomberg. He noted that because gold is a universal asset and has a some 4,000-year history, it is better positioned than, for instance, cryptocurrencies as a hedge against an inflationary environment. McEwen noted that the post-pandemic global monetary and debt expansion combined with supply disruptions will inevitably lead people to traditional methods of protecting their capital, with gold the leading choice.

For more stories on economy & finance visit RT's business section

(RT.com)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Cincinnati Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Cincinnati Sun.

More InformationInternational

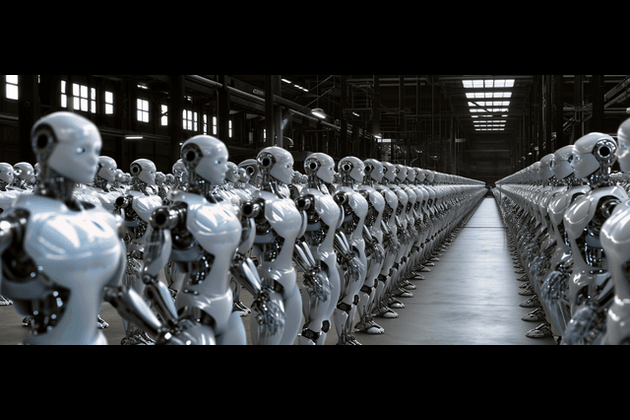

SectionBeijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

COVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

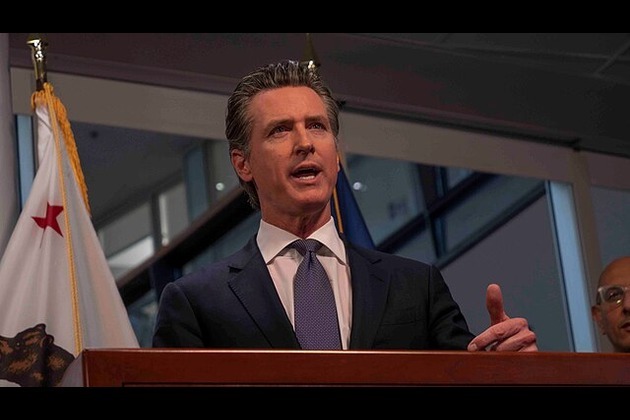

Fox faces $787 million lawsuit from Newsom over Trump phone call

DOVER, Delaware: California Governor Gavin Newsom has taken legal aim at Fox News, accusing the network of deliberately distorting...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

Israel should act fast on new peace deals, Netanyahu says

JERUSALEM, Israel: Israeli Prime Minister Benjamin Netanyahu says that Israel's success in the war with Iran could open the door to...

Business

SectionLululemon accuses Costco of selling knockoff apparel

Vancouver, Canada: A high-stakes legal showdown is brewing in the world of athleisure. Lululemon, the Canadian brand known for its...

Shell rejects claim of early merger talks with BP

LONDON, U.K.: British oil giant Shell has denied reports that it is in talks to acquire rival oil company BP. The Wall Street Journal...

Wall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....